How to automate employee onboarding

Challenge

Managing a workforce of 130 employees across two locations presents significant operational challenges. While the business had established systems with Deputy for timesheets and rostering, with payroll completed in either Xero or MYOB, the onboarding process had become a critical bottleneck.

The seasonal nature of the business demands rapid hiring, with some weeks requiring up to 10 new staff members to be onboarded. The manual onboarding process simply couldn’t keep pace with this volume, directly impacting operations. More critically, essential compliance documents weren’t being consistently collected, including right to work verification, exposing the business to unnecessary regulatory risk.

While Deputy offers an integrated onboarding solution, the per-employee pricing model was viewed as unviable. The business needed an automated system that can handle rapid onboarding at scale without breaking the bank.

Solution

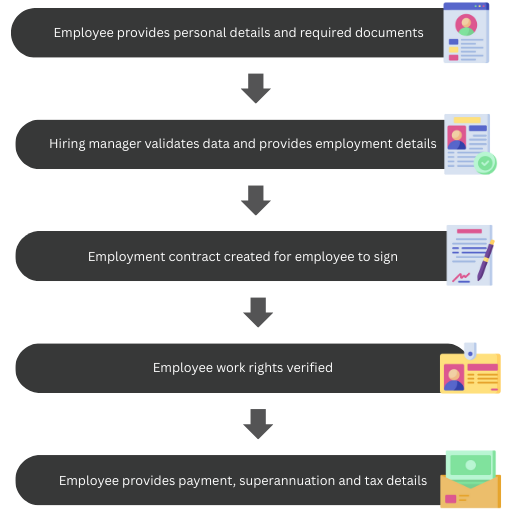

By leveraging a variety of tools, a comprehensive onboarding workflow was developed that manages the entire lifecycle of a new hire. The system seamlessly handles everything from the initial collection of employee data and right-to-work verification to automatically syncing that information with both Deputy and the site’s accounting package. This strategic choice of platforms kept implementation and running costs to a minimum while virtually removing the manual administrative burden. Most importantly, it ensured that the business’s record-keeping is now fully compliant with all legislative requirements.

Platforms Required

For the MYOB platform:

For the Xero platform:

Regarding currency

Although I am based in Australia, most of these platforms list their pricing in US dollars. For consistency, where possible costs have been presented in USD, with AUD amounts included when available.